Managing Your Own Rental Property in New Jersey: A How-To Guide

- Daniel Rivera

- Jun 2, 2024

- 14 min read

Updated: Aug 5, 2024

Introduction

Can you manage your own rental property in New Jersey? In short, yes, you can, but it comes with its own set of responsibilities and challenges.

Here's a quick answer:

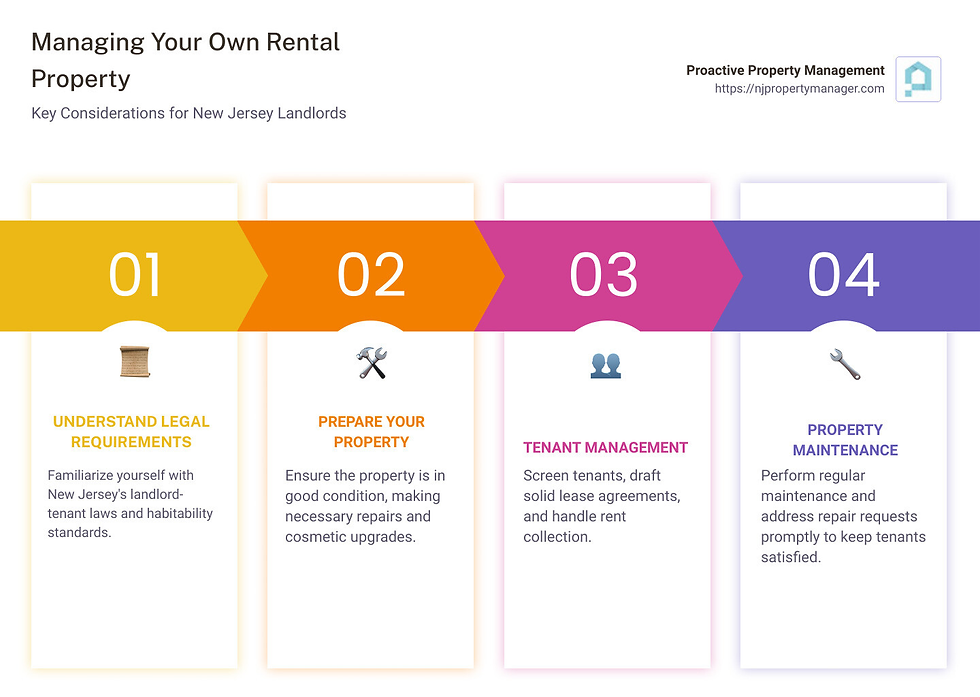

Yes, you can manage your own rental property in New Jersey.

Be prepared to understand detailed legal requirements.

Consider the time and effort needed for effective management.

Managing your own rental property in New Jersey can be a rewarding venture. You gain full control over your investment, potentially maximize your profits, and have a hands-on role in maintaining your property and dealing with tenants.

However, it’s not without challenges. New Jersey has strict laws governing landlord-tenant relationships, habitability standards, and more. Managing these legal aspects, while ensuring your property remains in top condition and your tenants are happy, can be time-consuming and complex.

Getting it right involves thorough preparation and understanding of local laws, efficient handling of tenant relations, and prompt attention to maintenance and repairs. For property owners who live far away or own multiple units, self-management can quickly become overwhelming.

Understanding Legal Requirements

Managing your own rental property in New Jersey can be rewarding but requires a solid grasp of the state's legal requirements. Here’s what you need to know:

NJ Landlord-Tenant Laws

New Jersey has specific laws that govern the relationship between landlords and tenants. These laws cover everything from lease agreements to eviction procedures. Understanding these laws is crucial to avoid legal pitfalls.

Habitability Laws

New Jersey laws mandate that rental properties meet certain habitability standards. This means your property must be safe and livable. Make necessary repairs and ensure all essential services like heating, plumbing, and electricity are in working order.

Lease Agreements

A well-drafted lease agreement is your best protection as a landlord. It should clearly outline:

Rent amount and payment due dates

Security deposit details

Maintenance responsibilities

House rules

A comprehensive lease can prevent misunderstandings and legal disputes down the road.

Security Deposit Laws

New Jersey places a limit on security deposits. Landlords can’t charge more than one and a half times the monthly rent as a security deposit. Additionally, you must return the deposit within 30 days of lease termination, minus any deductions for damages.

Eviction Procedures

Evictions in New Jersey are governed by the Anti-Eviction Act, which provides tenants with robust protections. To evict a tenant, you must follow a strict legal process:

Provide Notice: Give the tenant a written notice stating the reason for eviction.

File a Complaint: If the tenant doesn’t comply, file a complaint with the local court.

Court Hearing: Attend a court hearing where both parties can present their case.

Warrant for Removal: If the court rules in your favor, obtain a warrant for removal.

Failure to follow these steps can result in legal complications and delays.

Ensuring compliance with New Jersey’s landlord-tenant laws is essential for a smooth and profitable rental experience. For more detailed information, you can refer to the New Jersey Department of Community Affairs.

Can You Manage Your Own Rental Property in New Jersey?

Licensing Requirements

In New Jersey, you can manage your own rental property without needing a broker's license if you are the bona fide owner of the property. This is a significant exemption that allows property owners to handle their own leasing, renting, and rent collection activities without the need for additional licensing.

However, if you plan to manage properties that you do not own, you must obtain a broker's license. According to New Jersey real estate licensing laws, anyone who rents, leases, collects rents, lists properties, or negotiates rental agreements must hold a broker’s license. A salesperson license allows you to perform these activities under the supervision of a licensed broker.

Here are some key points to remember about licensing:

Broker's License: Required for managing properties you do not own, involving activities like renting, leasing, and collecting rents.

Salesperson License: Allows you to perform real estate activities under a licensed broker’s supervision.

Exemptions: Bona fide property owners managing their own properties are exempt from these licensing requirements.

For more detailed information about licensing requirements, you can visit the New Jersey Real Estate Commission's Licensing and Education webpage.

Legal Compliance

Managing your own rental property means you must comply with various legal requirements to ensure you are acting within the law and protecting tenant rights.

Tenant Rights and Fair Housing Act: As a landlord, you must adhere to the Fair Housing Act, which prohibits discrimination based on race, color, religion, sex, national origin, familial status, or disability. This means you must be fair and non-discriminatory in your tenant selection process.

Local Ordinances: Different municipalities in New Jersey might have specific ordinances governing rental properties. These can include regulations on property maintenance, noise control, and occupancy limits. Make sure to familiarize yourself with local laws to avoid legal issues.

Security Deposit Laws: New Jersey has strict laws regarding security deposits. You cannot charge more than one and a half times the monthly rent as a security deposit. Additionally, you must return the deposit within 30 days of the tenant moving out, minus any deductions for damages beyond normal wear and tear.

Eviction Procedures: If you ever need to evict a tenant, you must follow New Jersey’s detailed eviction process. This includes providing proper notice and filing for eviction through the court system. Failure to follow these steps can lead to legal complications and delays.

For more comprehensive information on tenant rights and landlord obligations, you can refer to the New Jersey Department of Community Affairs.

By understanding and adhering to these licensing requirements and legal obligations, you can successfully manage your own rental property in New Jersey, ensuring a smooth and lawful rental experience.

Next, let's explore how to prepare your property for renting.

Preparing Your Property

Market Research

Before you list your rental property, understanding the market is crucial. This involves knowing the rental rates in your area, which can vary based on location factors, property size, and amenities.

Example: In Essex County, properties near public transportation and good schools generally command higher rents. A two-bedroom apartment in this area might rent for $1,800 to $2,200 per month, while a similar property in a less desirable location might only fetch $1,200 to $1,500.

Property Condition

A well-maintained property attracts better tenants and can justify higher rent. Here are some steps to ensure your property is in top shape:

Necessary Repairs: Fix any broken appliances, leaky faucets, or structural issues. Ensuring everything works correctly is part of habitability compliance.

Cosmetic Upgrades: Consider fresh paint, new carpeting, or modern light fixtures. These small investments can make a big difference in the property's appeal.

Habitability Compliance: New Jersey laws require that rental properties meet certain standards. This includes proper heating, plumbing, and electrical systems. You can find more details in the New Jersey Department of Community Affairs.

Property Maintenance

Once your tenant moves in, regular maintenance is key to keeping your property in good condition and your tenants happy.

Repair Requests: Address these promptly. A quick response can prevent minor issues from becoming major problems.

Periodic Inspections: Conduct regular inspections to check for any maintenance issues and ensure the property remains in good condition. This can help you catch problems early and maintain the property's value.

Tip: Keep a schedule for periodic inspections and routine maintenance tasks like HVAC servicing and gutter cleaning.

By thoroughly preparing your property and staying on top of maintenance, you can create a positive renting experience for both you and your tenants. This approach not only helps you comply with legal requirements but also enhances the property's marketability and long-term profitability.

Next, let's dive into effective tenant management strategies.

Tenant Management

Effective tenant management is essential for maintaining a smooth and profitable rental operation. This involves thorough tenant screening, crafting solid lease agreements, efficient rent collection, and fostering positive tenant relationships.

Effective Tenant Screening

Screening potential tenants is crucial to finding reliable and responsible occupants. Here's a step-by-step guide:

Credit Checks: Assess the financial responsibility of potential tenants. Look for a good credit score and a history of timely payments.

Employment Verification: Ensure tenants have a stable income source. Verify their employment status and income level to confirm they can afford the rent.

Rental History: Contact previous landlords to get insights into the tenant's rental history. This can reveal patterns of late payments, property damage, or other issues.

Criminal Background Checks: Conduct background checks to ensure the safety and security of your property and other tenants. Be sure to comply with the Fair Housing Act and avoid discriminatory practices.

Example: A landlord in Essex County found that thorough screening helped avoid problematic tenants. By following these steps, they reduced late payments and property damage incidents significantly.

Drafting a Solid Lease Agreement

A comprehensive lease agreement is your protection as a landlord. It should clearly outline the terms of the rental, including:

Rent Amount: Specify the monthly rent and any additional fees.

Payment Due Dates: State the due date for rent payments and any late fees for overdue payments.

Security Deposit Details: Include the amount and conditions for its return.

Maintenance Responsibilities: Clarify who is responsible for maintenance tasks and repairs.

House Rules: Outline any specific rules, such as no-smoking policies or pet restrictions.

Tip: Use clear and simple language in your lease agreement to avoid misunderstandings.

Rent Collection

Efficient rent collection is vital for maintaining cash flow and covering expenses. Here are some tips:

Online Payment Options: Offer convenient online payment methods. This can increase on-time payments and reduce the hassle of manual collection.

Automated Reminders: Set up automated reminders for upcoming rent due dates to ensure tenants are aware.

Enforcement of Late Fees: Clearly state and enforce late fees to encourage timely payments.

Example: A New Jersey landlord who implemented online payment options saw a 20% increase in on-time rent payments within the first three months.

Tenant Relationships

Maintaining positive tenant relationships can lead to longer tenancy periods and fewer disputes. Here are some strategies:

Effective Communication: Be responsive to tenant concerns and repair requests. Good communication builds trust and satisfaction.

Regular Updates: Keep tenants informed about any changes or updates related to the property.

Respect Privacy: Respect tenants' privacy by providing advance notice for inspections or maintenance visits.

Quote: "Good tenant relationships are the cornerstone of successful property management. Happy tenants are more likely to renew their leases and take better care of the property." - Michelle Garcia, experienced New Jersey landlord

By focusing on effective tenant screening, drafting solid lease agreements, efficient rent collection, and maintaining positive tenant relationships, you can ensure a smooth and profitable rental operation in New Jersey.

Next, we'll explore how to market your property effectively to attract quality tenants.

Marketing Your Property

Effective marketing is essential to attract quality tenants. To stand out in the competitive New Jersey rental market, consider a multi-faceted approach that includes online platforms, social media, traditional methods, and high-quality photos.

Online Platforms

Online rental platforms like Zillow, Trulia, and Apartments.com are popular choices for listing your property. These platforms allow you to reach a wide audience and provide tools to manage inquiries and applications seamlessly.

Tip: Utilize the advanced features of these platforms, such as virtual tours and 3D walkthroughs, to give potential tenants a comprehensive view of your property.

Social Media

Social media is a powerful tool for marketing your rental property. Platforms like Facebook, Instagram, and LinkedIn can help you reach a broader audience and engage with potential tenants.

Tip: Create engaging posts with high-quality photos and detailed descriptions. Use hashtags relevant to your location, such as #NewJerseyRentals or #EssexCountyHomes, to increase visibility.

Traditional Methods

While digital marketing is crucial, don't overlook traditional methods, especially if your property is in a tight-knit community. Local newspaper ads, community bulletin boards, and word-of-mouth can also attract reliable tenants.

Tip: Attend local community events to network and spread the word about your rental property.

High-Quality Photos

High-quality photos can significantly increase interest in your property. Ensure that your photos are well-lit and highlight the best features of the property, such as spacious rooms, modern appliances, and unique amenities.

Example: A well-maintained garden or a newly renovated kitchen can be strong selling points.

Move-In Inspection

Conducting a thorough move-in inspection is crucial to document the property's condition before the tenant moves in. This step helps protect you from disputes over damages when the tenant moves out.

Checklist:

Inspect all rooms, noting any existing damage.

Test all appliances and fixtures.

Take high-resolution photos of each room.

Create a detailed written report.

Tip: Share a copy of the inspection report with the tenant and have them sign it to acknowledge the property's condition.

By using a combination of online platforms, social media, traditional methods, and high-quality photos, and by conducting a thorough move-in inspection, you can effectively market your property and attract quality tenants.

Next, we'll delve into financial management strategies to ensure your rental property remains profitable.

Financial Management

Planning for Vacancies

Managing your own rental property in New Jersey requires a solid financial plan, especially for those inevitable vacancies. Here’s how to handle different aspects of financial management effectively:

Rent Collection

Collecting rent on time is crucial. Consider using online platforms for rent collection to streamline the process. This not only ensures timely payments but also reduces the risk of human error.

Financial Reporting

Keep detailed financial records. This includes all income from rent and any expenses related to the property. Use property management software to generate regular financial reports, helping you track profitability and make informed decisions.

Tax Implications

Rental income is taxable, but you can also deduct many expenses. These include mortgage interest, property taxes, maintenance costs, and depreciation. Consult with a tax professional to understand your obligations and opportunities for savings. They can help you navigate complex tax laws and maximize your deductions.

Expense Deductions

You can deduct various expenses related to your rental property. These might include:

Mortgage interest

Property taxes

Maintenance and repairs

Insurance premiums

Depreciation

Make sure to keep all receipts and documentation to support your deductions.

Financial Cushion

Always have a financial cushion to cover unexpected expenses and vacancies. Aim to set aside at least three to six months' worth of operating expenses. This ensures you can handle repairs, legal fees, or other unexpected costs without financial stress.

Mortgage Payments

Even during vacancies, you’ll need to make mortgage payments. Plan for this by setting aside a portion of your rental income each month. Having a dedicated fund for mortgage payments can prevent financial strain during periods without tenants.

Property Improvements

Investing in property improvements can increase your rental income and attract quality tenants. Focus on upgrades that offer the best return on investment, such as kitchen and bathroom renovations. Regular maintenance and cosmetic upgrades can also help maintain property value and tenant satisfaction.

By following these financial management strategies, you'll be well-prepared to handle vacancies and ensure your rental property remains profitable.

Next, we'll explore the benefits of professional property management and when you might consider hiring a property manager.

Professional Help vs. Self-Management

Managing your own rental property in New Jersey can be rewarding, but it's also time-consuming and complex. Hiring a professional property manager can alleviate many of these challenges. Let's break down the benefits of professional management and when it might be the right choice for you.

Benefits of Professional Management

Time Savings

One of the most significant advantages of hiring a property manager is the time you'll save. Managing a property requires constant attention. From responding to tenant inquiries to handling emergencies, the demands are endless. A professional manager handles these tasks, giving you more time for other pursuits.

Cost Savings

Professional managers often have access to discounted rates for maintenance and repairs due to established relationships with contractors. This can save you money compared to handling these tasks on your own. Additionally, they can help minimize vacancy periods, reducing the financial impact of an empty property.

Professional Expertise

Property managers bring a wealth of expertise. They understand the local rental market, ensuring your property is competitively priced. They also have experience in tenant screening, lease agreements, and legal compliance, protecting you from costly mistakes.

Market Knowledge

A professional manager knows the New Jersey rental market well. This knowledge helps in setting the right rental price, marketing the property effectively, and attracting quality tenants. For example, they can use high-quality photos and virtual tours to showcase your property, as mentioned in Proactive Property Management.

Legal Compliance

Navigating New Jersey's complex property laws can be daunting. Professional managers stay updated on the latest regulations, ensuring your property complies with all local, state, and federal laws. This includes understanding tenant rights, security deposit laws, and eviction procedures.

Tenant Screening

Effective tenant screening is crucial for minimizing turnover and ensuring timely rent payments. Property managers conduct thorough background checks, including credit checks, employment verification, and rental history, to find reliable tenants.

Maintenance and Repairs

Keeping your property in good condition is essential for tenant satisfaction and property value. Professional managers handle regular maintenance, emergency repairs, and periodic inspections. They work with trusted contractors to ensure high-quality, cost-effective repairs.

When to Hire a Property Manager

Multiple Properties

If you own multiple rental properties, managing them all can be overwhelming. A property manager can streamline operations, ensuring each property is well-maintained and profitable.

Living Far from Rental

Managing a rental property from another state or even a distant city can be challenging. A local property manager can handle day-to-day operations, tenant communications, and emergencies, providing peace of mind.

Day-to-Day Operations

Managing a rental property involves numerous daily tasks. From rent collection and financial reporting to handling tenant complaints and legal issues, a property manager takes care of these responsibilities, allowing you to focus on other aspects of your life or business.

In conclusion, while managing your own rental property in New Jersey is possible, professional management offers significant advantages. If you find yourself overwhelmed or lacking the necessary expertise, hiring a property manager like NJPropertyManager . com can be a wise investment.

Frequently Asked Questions about Managing Your Own Rental Property in New Jersey

Do I need a license to be a property manager in NJ?

Yes, if you are performing certain real estate activities. New Jersey law requires a real estate broker’s license for anyone engaging in leasing, collecting rent, or negotiating contracts for multifamily properties. If you don’t have this license, you can’t legally manage these activities yourself. However, a licensed real estate salesperson working under a broker can perform these tasks.

Unlicensed assistants or support staff cannot engage in any leasing, marketing, or negotiating activities.

Do you need a license to be a landlord in NJ?

No, you don't need a license to be a landlord in New Jersey. Property owners are allowed to manage their own properties without a real estate broker’s license. This means you can handle leasing, rent collection, and maintenance for your own property. However, if you plan to manage properties for others, you’ll need to get licensed.

What can't a landlord do in New Jersey?

Being a landlord in New Jersey comes with strict rules to protect tenant rights. Here are some things you cannot do:

Discriminate: New Jersey’s Fair Housing guidelines are strict. You can't discriminate based on race, color, religion, sex, disability, familial status, national origin, sexual orientation, gender identity, or marital status.

Refuse Section 8 Vouchers: It’s illegal to refuse to rent to someone simply because they will pay with Section 8 vouchers.

Charge Excessive Security Deposits: You can’t charge more than one and a half times the monthly rent as a security deposit.

Ignore Maintenance Requests: Landlords must keep the property in a habitable condition, following state habitability laws.

Retaliate Against Tenants: You can't evict or punish tenants for complaining about living conditions or for exercising their legal rights.

Understanding these limitations can save you from costly legal issues and help you maintain a good relationship with your tenants.

Next, let’s dive into the steps you need to take to prepare your property for rental.

Conclusion

Managing your own rental property in New Jersey can be a rewarding experience, but it comes with its own set of challenges. From understanding legal requirements to maintaining the property and managing tenants, there's a lot to consider.

Key Takeaways:

Legal Requirements: Knowing New Jersey landlord-tenant laws and obtaining the right licenses are crucial. This includes understanding habitability laws, lease agreements, security deposit regulations, and eviction procedures.

Property Preparation: Ensuring your property is in good condition, conducting market research, and staying on top of maintenance tasks are essential for attracting and retaining tenants.

Tenant Management: Effective tenant screening, solid lease agreements, and maintaining good tenant relationships can make or break your rental business.

Financial Management: Keeping meticulous financial records, understanding tax implications, and planning for vacancies will help you manage your rental property successfully.

If you find managing your property overwhelming or time-consuming, consider hiring a professional property management company like Proactive Property Management. We offer expert market knowledge, legal compliance, efficient tenant screening, and comprehensive maintenance services to ensure your investment thrives.

Final Thoughts:

Renting out your property in New Jersey can be a lucrative venture if done right. Whether you decide to manage it yourself or hire a professional, being well-informed and prepared is key.

For more insights and professional assistance, visit Proactive Property Management. We're here to help you make the most out of your rental property investment.

Ready to take the next step? Contact us today to learn how we can help you manage your rental property effectively and efficiently.

Comments