2024's Top REITs: High Performers for Your Investment Strategy

- Daniel Rivera

- Sep 27, 2024

- 5 min read

If you're looking for top performing REITs to diversify your investment portfolio for 2024, you've come to the right place. Real Estate Investment Trusts (REITs) offer a unique opportunity for income investors to benefit from high yields and income distributions. These trusts own and often manage income-producing real estate, such as shopping centers, hotels, and office buildings.

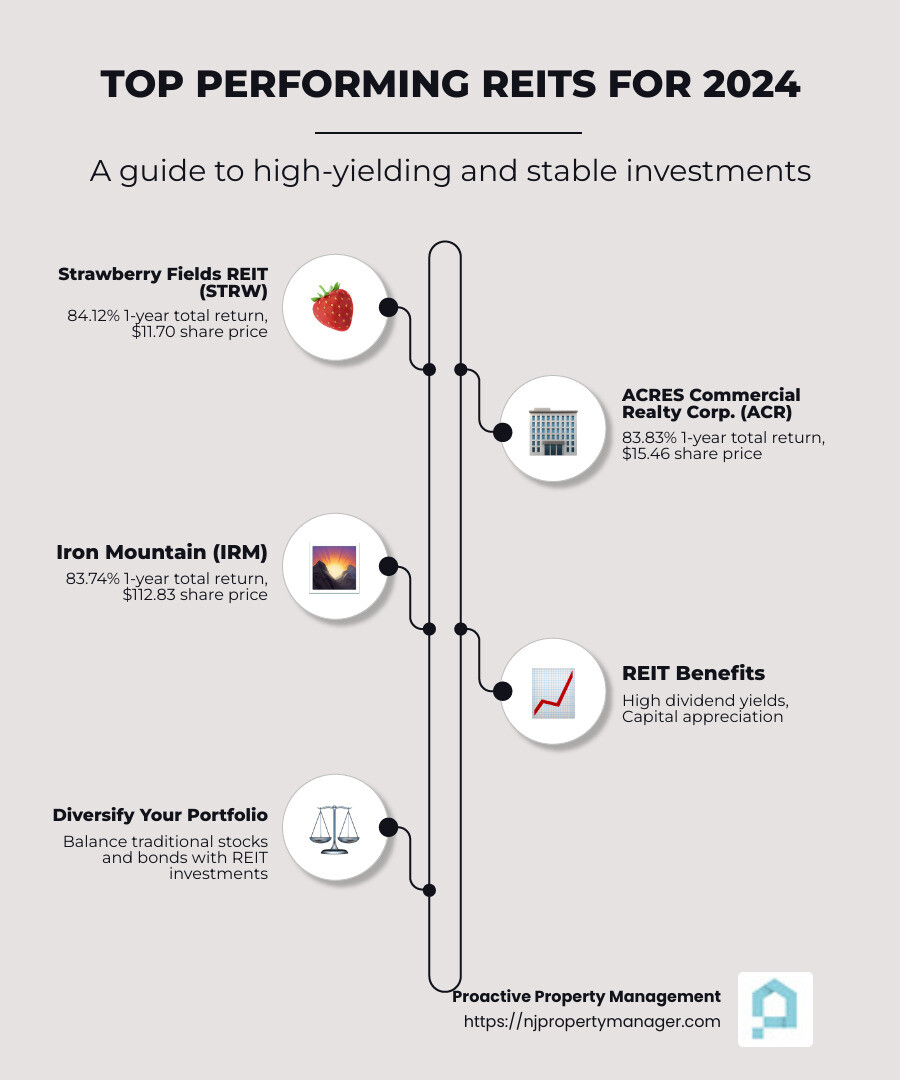

Here are some top performing REITs to consider:

Strawberry Fields REIT (STRW): 84.12% 1-year total return, $11.70 share price

ACRES Commercial Realty Corp. (ACR): 83.83% 1-year total return, $15.46 share price

Iron Mountain (IRM): 83.74% 1-year total return, $112.83 share price

When it comes to building a robust investment strategy, REITs offer high dividend yields and capital appreciation, making them an excellent counterbalance to traditional stocks and bonds.

My name is Daniel Rivera, owner of Proactive Property Management. With years of experience in real estate investing and property management, I understand the intricacies of finding and managing top performing REITs to maximize your investments.

Top Performing REITs of 2024

When it comes to building a robust investment strategy, REITs offer high dividend yields and capital appreciation. These characteristics make them excellent for diversifying your portfolio. Let's explore the top performing REITs of 2024 across various sectors.

Best Residential REITs

Armour Residential REIT (ARR) stands out in the residential sector. As a high-yielding mortgage REIT, Armour focuses on investing in mortgage-backed securities. With interest rates falling since July 2024, mortgage REITs like Armour have seen a boost. Armour's strategy of leveraging mortgage-backed securities has paid off, offering a compelling dividend yield of 12.1%.

Best Office REITs

Kilroy Realty (KRC) is a leader in the office REIT sector. Kilroy specializes in high-quality office spaces primarily located in West Coast markets. Despite economic uncertainty, Kilroy offers a solid dividend yield and has managed to maintain high occupancy rates. This makes it a reliable choice for those looking to invest in the office industry.

Best Hotel and Motel REITs

In the hotel and motel sector, Pebblebrook Hotel (PEB), Park Hotels & Resorts (PK), and Host Hotels & Resorts (HST) are top performers.

Pebblebrook Hotel: Trading at a significant discount, Pebblebrook is 49% below Morningstar’s fair value estimate. It focuses on owning independent and boutique hotels, and its recent renovations are expected to drive high revPAR growth.

Park Hotels & Resorts: Known for its premium properties in major urban and resort markets, Park Hotels offers a competitive dividend yield and has shown resilience post-pandemic.

Host Hotels & Resorts: As the largest lodging REIT, Host Hotels benefits from a diversified portfolio of upscale properties, making it a stable choice for investors.

Best Retail REITs

Macerich (MAC) is a standout in the retail REIT sector. Specializing in Class A malls, Macerich has successfully steerd the challenges posed by e-commerce by focusing on tenant sales productivity. The company's strategic locations and high-quality properties have led to consistent returns, making it a top choice for retail REIT investors.

Best Healthcare REITs

Healthpeak Properties (DOC) excels in the healthcare REIT sector. Investing in healthcare facilities, senior housing, and life sciences, Healthpeak has benefited from the aging population and the Affordable Care Act. Its diversified portfolio and strong balance sheet make it a reliable option for those looking to invest in healthcare real estate.

These REITs offer a mix of high returns, robust dividend yields, and strong market performance. Whether you're interested in residential, office, hotel, retail, or healthcare sectors, these top performers provide excellent opportunities for income and growth.

Next, we'll explore Top REIT ETFs to Consider for those looking for diversified portfolios without the hassle of analyzing individual stocks.

Top REIT ETFs to Consider

If you're looking to diversify your portfolio with the ease of investing in a single fund, REIT ETFs are an excellent option. They offer broad exposure to a variety of real estate sectors, providing a balanced mix of high returns and dividend income. Let's look at some top REIT ETFs to consider in 2024.

Vanguard Real Estate ETF (VNQ)

The Vanguard Real Estate ETF (VNQ) is the largest REIT ETF by assets under management, boasting over $34 billion as of mid-2024. This ETF is popular due to its low expense ratio of 0.13%, which is significantly lower than the industry average of 1.07%. This low cost allows investors to keep more of their returns.

VNQ offers broad exposure to the real estate market with a diverse portfolio that includes top holdings like Prologis, American Tower, and Equinix. These companies span various property types, from industrial to data centers, making VNQ a solid choice for those seeking comprehensive real estate exposure.

iShares U.S. Real Estate ETF (IYR)

Managed by BlackRock, the iShares U.S. Real Estate ETF (IYR) invests in domestic real estate stocks and REITs. As of mid-2024, IYR held about 70 stocks, with the largest allocations going to:

Prologis: 8.3%

American Tower: 7.3%

Equinix: 5.8%

Welltower: 4.5%

Digital Realty Trust: 4.0%

While IYR offers a slightly more concentrated portfolio compared to VNQ, it provides a good mix of industrial, communications infrastructure, and healthcare REITs. However, one downside is its higher expense ratio of 0.40%, which is above the industry average and can eat into returns over time.

Schwab U.S. REIT ETF (SCHH)

For those seeking simple and cost-effective access to REITs, the Schwab U.S. REIT ETF (SCHH) is a standout option. This ETF focuses solely on REIT holdings, excluding non-REIT real estate stocks, making it unique among its peers.

SCHH has an ultra-low expense ratio of 0.07%, which is one of the lowest in the industry. This allows investors to keep more of their returns, including a lucrative dividend yield of around 3.9%. The ETF's top holdings are similar to other top REIT ETFs, including American Tower, Prologis, and Equinix, providing diversified exposure to high-quality REITs.

These REIT ETFs allow you to invest in a diversified portfolio of real estate assets without the hassle of picking individual stocks. Whether you prioritize low costs, broad exposure, or specific market segments, there's a REIT ETF that can meet your investment needs.

Next, we'll dig into the Conclusion, summarizing the key takeaways and how Proactive Property Management can help you maximize your property investments.

Conclusion

Investing in top-performing REITs can be a smart strategy for diversifying your portfolio and generating steady income. Whether you choose individual REITs or REIT ETFs, these investments offer the potential for high returns and regular dividends.

To summarize:

REITs provide an easy way to invest in real estate without owning physical property.

Top-performing REITs like Strawberry Fields REIT, ACRES Commercial Realty Corp., and Iron Mountain have shown impressive returns.

REIT ETFs such as Vanguard Real Estate ETF (VNQ), iShares U.S. Real Estate ETF (IYR), and Schwab U.S. REIT ETF (SCHH) offer diversified exposure and ease of investment.

At Proactive Property Management, we specialize in maximizing the value of your property investments. Our comprehensive services include:

Strategic Marketing and Leasing: Ensuring minimal vacancy periods and optimal tenant placement.

Rigorous Tenant Screening: Conducting detailed background checks and income verifications.

Seamless Rent Collection: Offering convenient online payment options and timely disbursements.

Proactive Maintenance Coordination: Providing 24/7 emergency repair services and regular property inspections.

Transparent Financial Reporting: Giving you real-time access to financial data and detailed reports.

Our goal is to provide a seamless experience for property owners and tenants alike, leveraging advanced technology for transparency and efficiency.

Ready to take your property investments to the next level? Find our services and see how we can help you achieve your investment goals.

Comments